New Tax Plan Risks State’s Long-Term Fiscal Health, Worsens Income and Racial Inequities

[ad_1]

House Bill 1437, signed into law by Gov. Kemp after a final version emerged during the last hours of Sine Die 2022, sets Georgia on course to make fundamental changes to its income tax that primarily benefit the state’s highest earners at an annual cost greater than $2 billion when fully implemented.[1],[2]

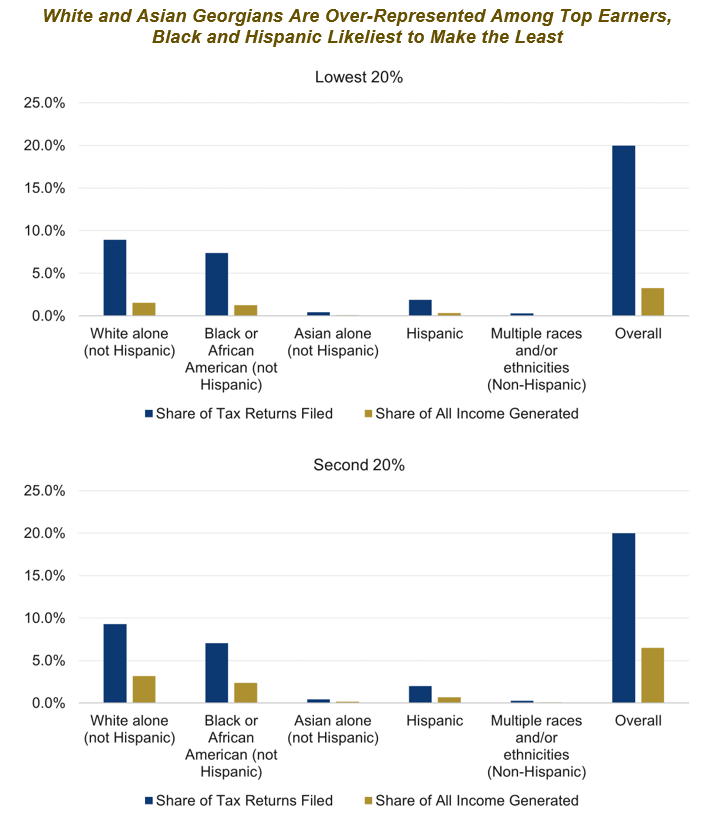

Beyond adding to existing disparities in income by directing approximately 68 percent of all tax cuts to those in the top 20 percent, the changes would also widen the gaps across income and wealth between white and Asian households, who tend to already make higher than average incomes and would benefit from the greatest share of tax cuts, and Black and Hispanic Georgians, who on average earn lower incomes and see the fewest savings.

Although the legislation requires overall revenue growth of at least three percent to proceed without interruption through seven steps to achieve full implementation by 2030—if no delays are initiated—forgoing $2 billion in annual personal income tax revenues threatens the long-term stability of Georgia’s revenue system and places a continued burden on the state’s ability to meet the needs of its residents. Already, Georgia ranks No. 48 out of 50 in the amount of general state revenues it raises per person.[3]

Most of state government revenue goes to fund public education and health care, which make up nearly three-quarters of all spending in the FY 2023 budget.[4] Although the state’s revenue collections have outpaced recent estimates issued by Gov. Kemp, a host of core state programs and services, such as public education, have historically been underfunded by budget cuts made in response to recessions and fluctuations in revenue collections. Facing recurring cuts to the state’s largest source of revenue over the next decade, it is likely that future tax increases or spending cuts necessary to cover the revenue lost to the state would most affect Georgians with low and moderate incomes.

Executive Summary

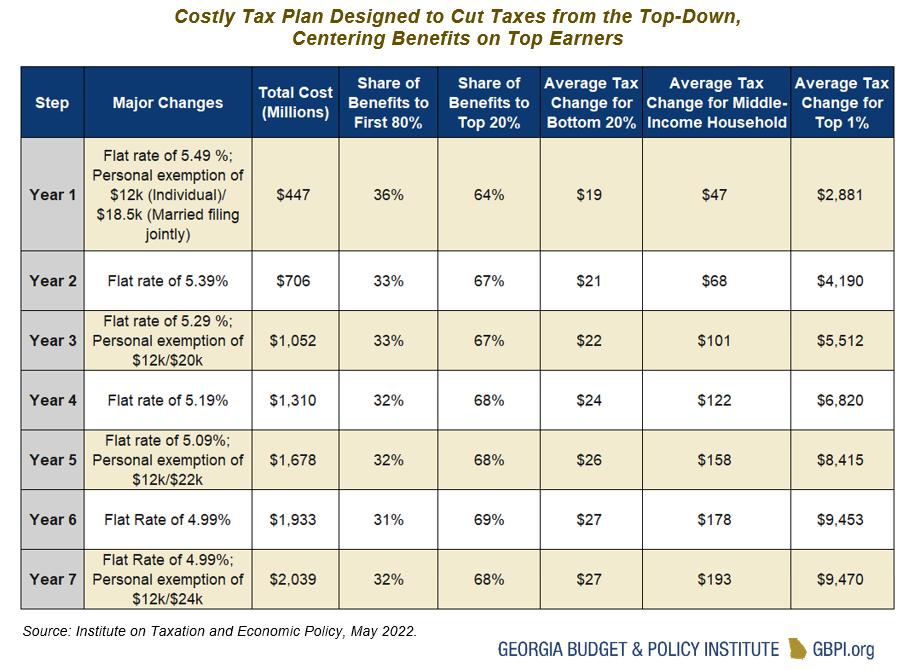

Gov. Kemp has signed HB 1437 into law, initiating a costly multi-year tax cut plan that takes effect beginning in January 2024 and would reduce state revenues by $2.04 billion per year if fully implemented.

Under the full bill, most tax savings would be directed to Georgia’s top earners, with 22 percent of all tax cuts going to the top 1 percent (over $603,000 per year), 68 percent going to the top 20 percent (over $107,000 per year) and 84 percent of $2 billion in net tax cuts to the top 40 percent (over $62,000).

The first 60 percent of Georgia tax filers, those with the lowest incomes, would see just 16 percent of the legislation’s total tax savings, about $318 million of $2.04 billion, shared by approximately 3 million Georgia families and individuals. For these Georgians, the average tax change amounts to a cut of less than $200 per year.

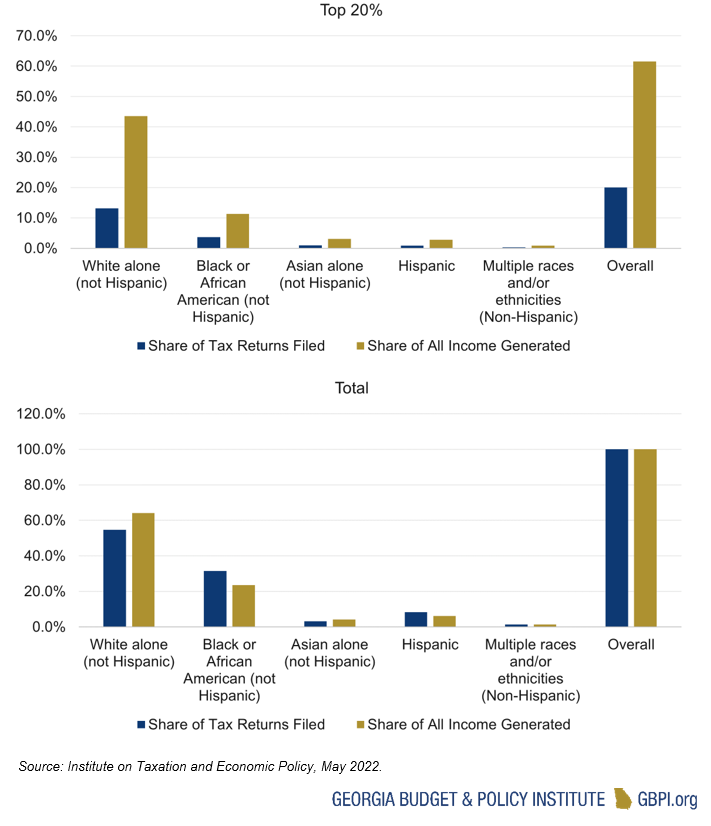

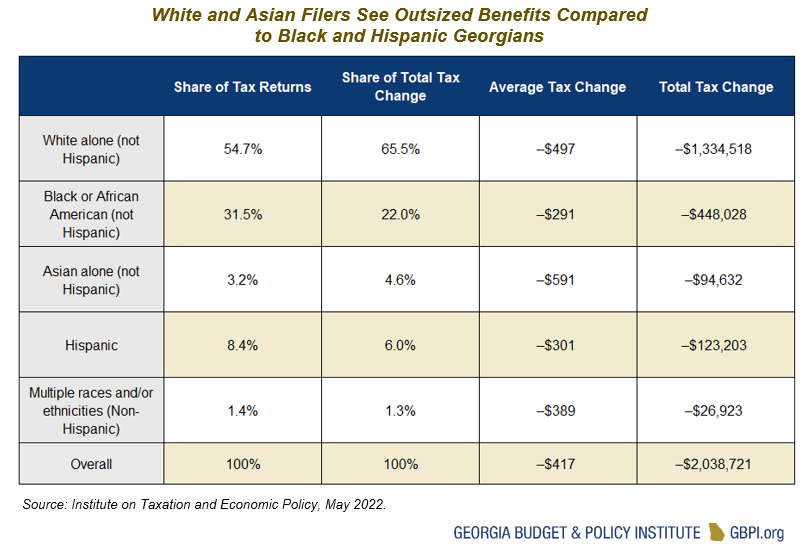

Due in part to policies historic and systemic that have contributed to lower levels of income and wealth for Black Georgians and people of color, this proposal would worsen racial inequities and expand the racial wealth gap. White Georgians (55 percent of tax filers) would see 66 percent of total benefits, and Asian Georgians (3.2 percent) would gain 4.6 percent of savings, while Black Georgians (32 percent) would see just 22 percent, and Hispanic Georgians (8 percent) benefit from 6 percent of the total tax cuts.

The package is estimated to cause over $2 billion in annual revenue losses, equivalent to over 14 percent of all personal income tax revenues estimated to be raised in FY 2023.[5] This is nearly equivalent to the amount the state spends on infrastructure annually through the Department of Transportation, Georgia’s No. 4 largest agency.

The tax changes would become effective beginning on January 1, 2024 and are set to be implemented over a period of at least 7 years.

Tax Plan Prioritizes Top Income Earners, Offers Few Savings to Most Georgians at Mammoth Cost

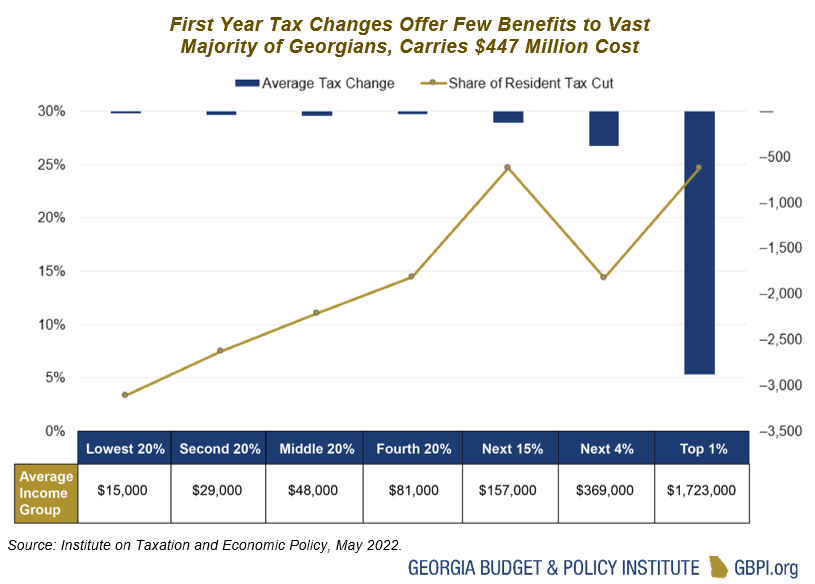

The largest tax cuts offered under the legislation, both in terms of dollar amount and share of income, are directed towards those earning the highest incomes. In its first year, the legislation carries a cost of $447 million. Approximately 64 percent of that, or $285 million, would exclusively benefit the top 20 percent, while most Georgians would experience minimal benefits. Although those in the top 1 percent would see an average tax change of about $2,900 per year, most Georgians would receive less than $100 annually in tax cuts.

Following its initial implementation in 2024, the state would be on course to take six additional steps to fully execute the legislation, eventually reaching a total cost of $2.04 billion. If the state does not achieve certain benchmarks, which include maintaining overall revenue growth of at least 3 percent annually, the bill’s prescribed steps would be paused for one year. Largely, as each successive step is implemented, the legislation’s effects become increasingly regressive and contribute to Georgia’s racial wealth gap.

Summary of HB 1437

- Beginning in January of 2024, Georgia’s personal income tax is set to shift from a graduated system, where tax rates increase from 1 to 5.75 percent so that everyone pays their fair share, to a flat tax of 5.49 percent, where the wealthy benefit the most. After the implementation of the flat tax, if certain revenue benchmarks are met, the rate would decrease by 0.1 percentage points annually for five years until it reaches 4.99 percent.

- The bill includes three triggers to protect state revenue collections. If any of these are not met, the change in tax rates is delayed by one year.

- The governor’s revenue estimate for the succeeding fiscal year must be 3 percent above the revised revenue estimate for the present year;

- the prior fiscal year’s revenue collection must be higher than each of the preceding five fiscal years, and

- the Revenue Shortfall Reserve must contain a sum that exceeds the amount of the decrease in state revenues projected.

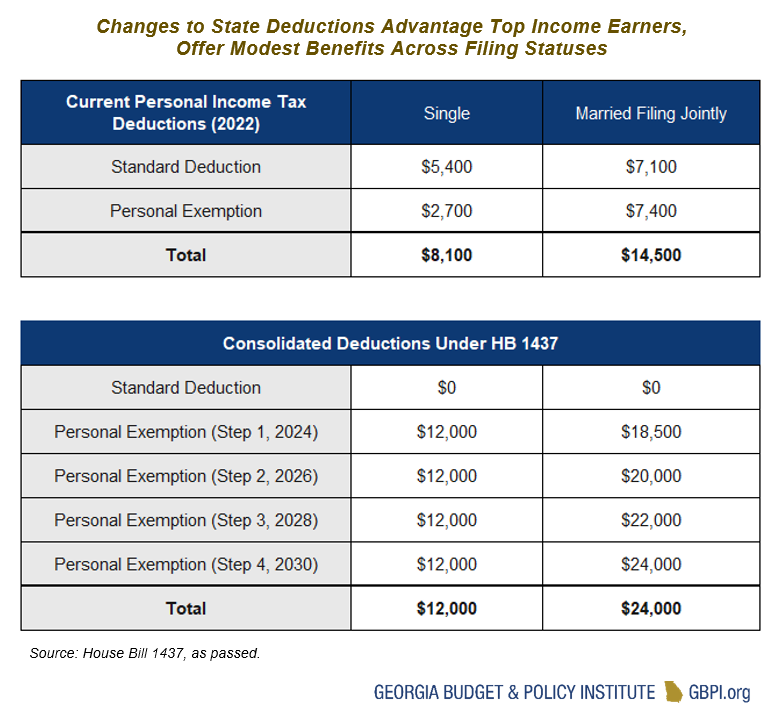

- The state’s standard deduction of $5,400 for single filers and $7,100 for married filers filing jointly is eliminated in favor of raising the existing personal exemption, which all filers are eligible to claim.

- Those who itemize federally would see outsized benefits from the redirection of the resources devoted to Georgia’s existing standard deduction. In 2024, the personal exemption would be increased to $12,000 annually for single filers and $18,500 for married couples filing jointly. If revenue benchmarks are met biannually through 2030, the personal exemption for married filers would gradually increase to $24,000.

- Enacts a minor increase to the state’s exclusion on retirement income from $4,000 to $5,000 annually.

- Makes permanent the current itemized deduction cap of $10,000 for state and local taxes paid.

- Requires the House Ways and Means Committee and the Senate Finance Committee to jointly review all state tax credits, deductions and exemptions by May 1, 2023, and to produce a report to the full General Assembly by December 1, 2023.

Families with Low, Middle and Fixed Incomes Shoulder Costs of Massive Tax Cuts for Earners with High Incomes; Multi-Year Plan Jeopardizes Fiscal Outlook

By eliminating Georgia’s current graduated personal income tax in favor of adopting a flat tax, along with consolidating the state’s standard deduction to offer a larger personal exemption to all filers—including those who itemize on their federal returns—HB 1437 represents a marked shift toward those with the highest incomes and away from Georgians with low and moderate incomes.

Under Georgia’s current structure, filers must follow the same selection when filing state income taxes that is used on their federal tax return, in which they select between claiming the flat “standard deduction” to determine their taxable income or using individual itemized deductions, such as mortgage interest or medical expenses.

Eliminating the standard deduction to bolster the personal exemption is a more regressive version of one of the key components of the federal 2017 Tax Cuts and Jobs Act, which took the opposite track of eliminating the federal personal exemption to help finance the costs of substantially increasing the standard deduction.[6] By choosing the reverse path, the state is unnecessarily skewing the benefits of the overall package to filers with higher incomes, namely those who itemize and will benefit from the same personal exemption increase as those who use the federal standard deduction but are unable to claim itemized deductions at the state level.

Greater than 85 percent of Georgians currently use the standard deduction, whereas itemizing deductions is most common among filers with higher incomes.[7] Going forward under HB 1437, filers would still only be allowed to claim itemized deductions on their state tax returns if they do so on their federal return. Although the new personal exemption levels are higher than the previous combined value of the standard deduction and personal exemption, which is currently $8,100 for single filers and $14,500 for married couples filing jointly, the choice to increase the personal exemption rather than the more targeted standard deduction diminishes potential benefits to most Georgians. Beginning in the 2024 tax year, single Georgians would be eligible for a $12,000 personal exemption and married joint filers would receive $18,500, which would gradually increase over biannual steps to $24,000.

When fully implemented, the approximately 50,000 filers who rank among the top 1 percent with incomes above $603,000 per year, would average nearly $9,500 per year in tax savings. On the other hand, the 1 million households who comprise the bottom 20 percent, earning less than $23,000 per year, would save an average of $27 per year.

For Georgia families earning the median income or less, these pending tax changes would offer little to lift incomes or meaningfully increase economic opportunity. Rather, the changes may redirect resources from programs and services that could otherwise support working families to instead widen disparities across income, race and ethnicity.

Tax Plan Grows Racial Wealth and Income Gaps, Most Benefits Sent to White and Asian Georgians

Already, state and local taxes consume a greater share of income earned by Georgians in poverty—who are more likely to be people of color—while the richest pay a far lower share of their income in taxes.[8] As such, Georgians who are among the bottom 20 percent of income earners, those who make less than $23,000 per year, pay approximately 10.4 percent of their income in state and local taxes, while those in the top 1 percent, making more than $603,000 per year, pay approximately 7 percent of their income in state and local taxes.[9]

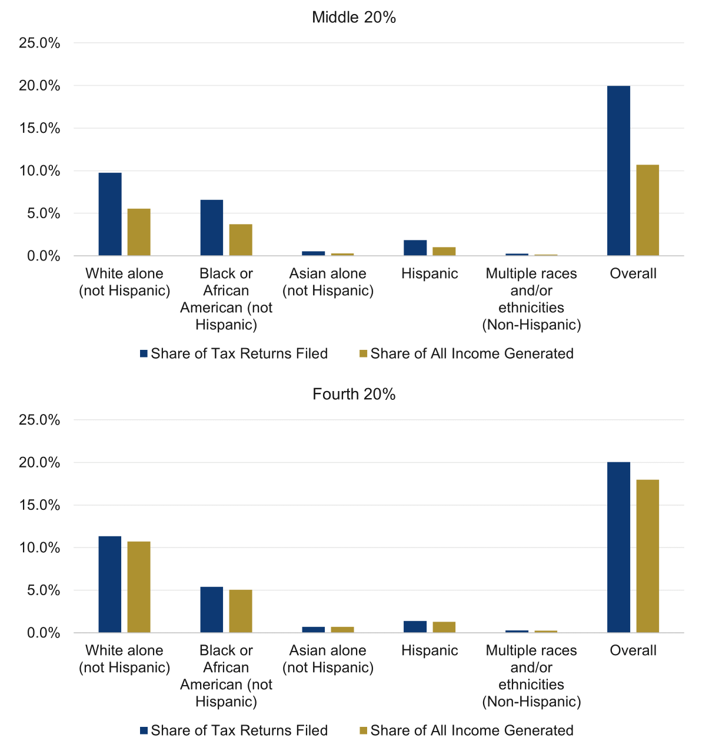

White and Asian households are likelier to earn higher incomes at a greater frequency than Black or Hispanic households, while the highest income earners dominate the share of income generated by all households. Currently, the earnings of those in the top 20 percent comprise 62 percent of all income generated in Georgia, while the bottom 40 percent of workers make less than 10 percent. Disaggregated by race and ethnicity, white Georgians claim 64 percent of all income earned, while Black Georgians make 24 percent, Asian workers earn 4 percent and Hispanic Georgians claim a 6 percent share.

When comparing the share of tax benefits that would go to earners across all races and ethnicities under the legislation if fully implemented, white Georgians are over-represented by approximately 20 percent, and Asian households see approximately 43 percent more in benefits than would be expected under an even distribution according to the share of tax returns filed. On the other hand, Black Georgians see 30 percent less in benefits than would otherwise be expected under an even distribution, with only 22 percent of total tax savings going to the 32 percent of Black or African American filers, and Hispanic filers experience a difference of 28 percent less in tax savings. These disparities only serve to enhance gaps in income and wealth that have been formed due to historic and systemic policies that have contributed to already-lower earnings for Black and Hispanic families.[10]

More than anything else, the simple breakdowns of the total tax change experienced by each group demonstrate how the full plan would widen racial income inequality. Existing levels of racial and economic inequality would be compounded by these tax changes that would ask white and Asian Georgians to pay less to finance the costs of government without directing similar benefits to Black and Hispanic Georgians earning lower incomes. A tax code that asks top earners to pay less means capturing less revenue to finance core functions of the state that contribute to greater equity, such as public education or Medicaid coverage. All Georgians should pay close attention to the relationship between tax cuts with outsized benefits for those with higher incomes and recurring trends of across-the-board budget cuts during periods of economic decline, persistent agency understaffing, and all-time high turnover rates for state employees that result in fewer constituent needs being met statewide.

Tax Reform Can Contribute to a More Equitable Georgia Without Destabilizing Revenues

The state has both an opportunity and obligation to raise sufficient revenue to meet the needs of Georgians, while maintaining a tax code that asks all Georgians to pay their fair share and without actively contributing to growing income and racial inequities. In recent years, Georgia leaders have prioritized policies that instead create a more regressive system of taxation, giving increasingly preferential treatment to the highest income earners and allowing a massive uptick in the amount of revenue lost to corporate subsidies. These changes have served to reduce overall revenue collections—thereby weakening the ability of state government to respond to the needs of its residents—while also exacerbating racial and income inequality by widening the gap between Georgia’s wealthiest and those in poverty.[11]

Adopting an Earned Income Tax Credit (EITC), as 30 states across the nation and federal government have enacted, offers the greatest opportunity to put more money in the pockets of low-income families at the lowest net cost.[12] Over 3.5 million Georgians are eligible for the federal EITC, including 1.5 million children. Its targeted design also incentivizes recipients to stay employed and work more hours while accounting for the number of children in each family. The credit would add balance to Georgia’s tax structure by reducing the total share of state and local taxes paid by families earning the least.

Finally, enacting legislation to weaken Georgia’s primary source of revenue, the personal income tax, by over $2 billion annually represents a dangerous threat to the state’s ability to finance its obligations over the long term. Furthermore, implementing these changes over a multiyear plan would serve to continually weaken revenue collections and harm the state’s ability to effectively keep pace with the growing needs of its residents. After the extreme volatility experienced during the pandemic-induced recession of 2020, many state programs and agencies are still reeling from the deep budget cuts implemented, while the state faces an all-time high turnover rate of 23 percent among employees.[13]

At the same time, the sizable infusion of federal funds that helped to sustain Georgia’s economy during the worst of the COVID-19 pandemic is tapering, adding further uncertainty to the sustainability of revenue collections as basic costs to maintain the status quo in state services are likely to continue to rise. Moreover, growing signals of instability in the global economy further enhance the risks of slashing Georgia’s primary source of revenue. Instead of addressing the many needs facing Georgians across education, economic mobility, access to health care, and fostering a responsive and adequately staffed government, state leaders are instead choosing to focus billions in state resources on a tax cut that will offer little to most workers and families.

As lawmakers prepare for the legislation to potentially take effect in Fiscal Years 2024 and 2025, it is not too late for members of the General Assembly to reverse course and enact policy that directs a significantly broader share of benefits to low- and middle-income families. Shouldering several years of deep revenue losses in order to enrich the state’s top earners, while helping to grow gaps across income and race, threatens a host of negative effects including risking Georgia’s long-term fiscal health.

Looking ahead, state leaders have abundant options to adopt more fiscally responsible measures to put more money in the pockets of working Georgians—such as enacting an Earned Income Tax Credit, or Georgia Work Credit, or preserving and increasing the existing standard deduction—without compromising the state’s capacity to raise revenue in the future or centering benefits on those at the top of the economic ladder.

Methodology

GBPI’s research on HB 1437 relies on estimates prepared by the Institute on Taxation and Economic Policy (ITEP) and GBPI’s analysis of other available information and data sources. Unless otherwise noted, the specific effects to filers—in the form of net-tax effects or offsetting tax cuts and tax increases—are sourced from ITEP estimates generated in May 2022. ITEP’s analysis simulates the effects of these legislative tax changes on approximately 4.9 million Georgia tax filers to produce estimates for the average tax change across quintiles of income. For components of income that are subject to income taxes, ITEP relies on information from the Internal Revenue Service’s “Statistics of Income” publication, which provides detailed state-specific information on components of income at different income levels. For components of income that are either fully or partially tax-exempt, ITEP uses data from the Congressional Budget Office and the Current Population Survey to estimate income levels in each state.

Endnotes

[1] Institute on Taxation and Economic Policy, May 2022.

[2] House Bill 1437 (Blackmon and others), as passed by the General Assembly. Accessed: https://www.legis.ga.gov/legislation/62346

[3] Georgia State University Fiscal Research Center, January 2022. “Georgia’s Rankings Among the States: Budget, Taxes and Other Indicators.” Accessed: https://frc.gsu.edu/files/2022/01/ga-rankings-among-the-states-budget-taxes-and-other-indicators-spread-2022.pdf

[4] Kanso, D. January 21, 2022. “Overview of Georgia’s 2023 Fiscal Year Budget”. Georgia Budget & Policy Institute. Accessed: https://gbpi.org/overview-of-georgias-2023-fiscal-year-budget/

[5] Governor’s Budget Report, Amended FY 2022 and FY 2023.

[6] Kanso, D. August 12, 2019. The Tax Cuts and Jobs Act in Georgia: High Income Households Receive Greatest Benefits.” Georgia Budget & Policy Institute. Accessed: https://gbpi.org/tax-cuts-and-jobs-act-georgia/

[7] Kanso, D. October 6, 2021. “Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial and Economic Inequality.” Georgia Budget & Policy Institute. Accessed: https://gbpi.org/reimagining-revenue-how-georgias-tax-code-contributes-to-racial-and-economic-inequality/

[8] Institute on Taxation and Economic Policy, May 2021. Data is based on 2015 levels and excludes elderly households, income levels refer to total income rather than taxable income alone.

[9] Institute on Taxation and Economic Policy, July 2021. Data is based on 2015 levels and excludes elderly households, income levels refer to total income rather than taxable income alone.

[10] Kanso, D. October 6, 2021. “Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial and Economic Inequality.” Georgia Budget & Policy Institute. Accessed: https://gbpi.org/reimagining-revenue-how-georgias-tax-code-contributes-to-racial-and-economic-inequality/

[11] Kanso, D. October 6, 2021. “Reimagining Revenue: How Georgia’s Tax Code Contributes to Racial and Economic Inequality.” Georgia Budget & Policy Institute. Accessed: https://gbpi.org/reimagining-revenue-how-georgias-tax-code-contributes-to-racial-and-economic-inequality/

[12] Williams, D. September 4, 2021. “General Assembly expected to take up state-level Earned Income Tax Credit.” Capitol Beat News Service. Accessed: https://www.moultrieobserver.com/news/general-assembly-expected-to-take-up-state-level-earned-income-tax-credit/article_fa60310c-0cf9-11ec-ad4e-3fb3e9935a57.html; Kanso, Danny. March 5, 2019. “Georgia Work Credit Grows the Middle Class.” Georgia Budget & Policy Institute. Accessed: https://gbpi.org/georgia-work-credit-grows-middle-class/

[13] Human Resources Administrative Division, Department of Administrative Services. July 1, 2020 – June 30, 2020. “State of Georgia TeamWorks HCM System Fiscal Year End 2021 Workforce Report”. Accessed: https://doas.ga.gov/assets/Human%20Resources%20Administration/Workforce%20Reports/Fiscal%20Year%20End%202021%20Workforce%20Report.pdf

[ad_2]

Source link