Millennials Are Doing Just Fine

[ad_1]

“Millennials are many things, but above all, they are murderers,” Mashable noted in 2017, introducing a list of 70 items and institutions that Millennials were purported to have “killed,” including napkins, breakfast cereal, department stores, the 9-to-5 workday, and marriage. The list was tongue-in-cheek—the cereal aisle persists—but it captured something essential about a generation that has reshaped old habits of American life.

Even amid this slaughter of tradition, Millennials are best known for another characteristic: how broke they are. Millennials, it’s often said, are the first American generation that will do worse than its parents financially.

Pick up a book on Millennials, or wander into a discussion about them online, and this theme pops up again and again: The once-optimistic children of the 1980s and early ’90s are now wheezing under the burden of college debt, too poor to buy houses or start families, sucker punched by a hostile economy that bears no resemblance to the one their parents enjoyed as young adults.

“We’re only now starting to grasp the degree to which we have gotten screwed,” Jill Filipovic wrote in her 2020 book, OK Boomer, Let’s Talk: How My Generation Got Left Behind, “and we’re responding with desperation and sometimes anger.” The famous rebuke that Filipovic takes as the book’s title isn’t mere snark, she writes; it’s “a final, frustrated dismissal from people suffering years of political and economic neglect.” In a Morning Consult poll last year, 45 percent of Millennials, compared with 35 percent of all adults, agreed with the statement “Because of my money situation, I will never have the things I want in life.” Fifty-two percent of Millennials said they were concerned that “the money I have or will save won’t last.”

The mythology of the generation begins with the participation trophies and limitless expectations granted to its members in childhood by parents and teachers newly eager to build self-esteem. (I wrote about the implications of that approach in my 2006 book, Generation Me.) But the story is centered on the wreckage of the Great Recession, when those youthful expectations violently collided with the worst financial crisis in nearly a century. The sense of betrayal in OK Boomer and other writings is both palpable and understandable. If anything, it only seems to have hardened over time.

Impressions of generations tend to form early, and they often get cast in amber. As a scholar of generations, I’m well aware of that. But even I was surprised when I returned to my study of Millennials to look at the generation as it enters middle age.

The surprise was this: Millennials, as a group, are not broke—they are, in fact, thriving economically. That wasn’t true a decade ago, and prosperity within the generation today is not evenly shared. But since the mid-2010s, Millennials on the whole have made a breathtaking financial comeback.

This is terrific news. And yet it’s not all good news, because the belief that Millennials have been excluded from the implicit promises that America makes to its people—a house for most, middle-class security, a better life than your parents had—remains predominant in society and, to go by surveys and the tenor of social media, among Millennials themselves.

That prompts a question with implications for the cultural and political future of the United States, a country premised, to a large extent, on the idea of material progress: What if the American dream is still alive, but no one believes it to be?

The Highest Incomes Ever

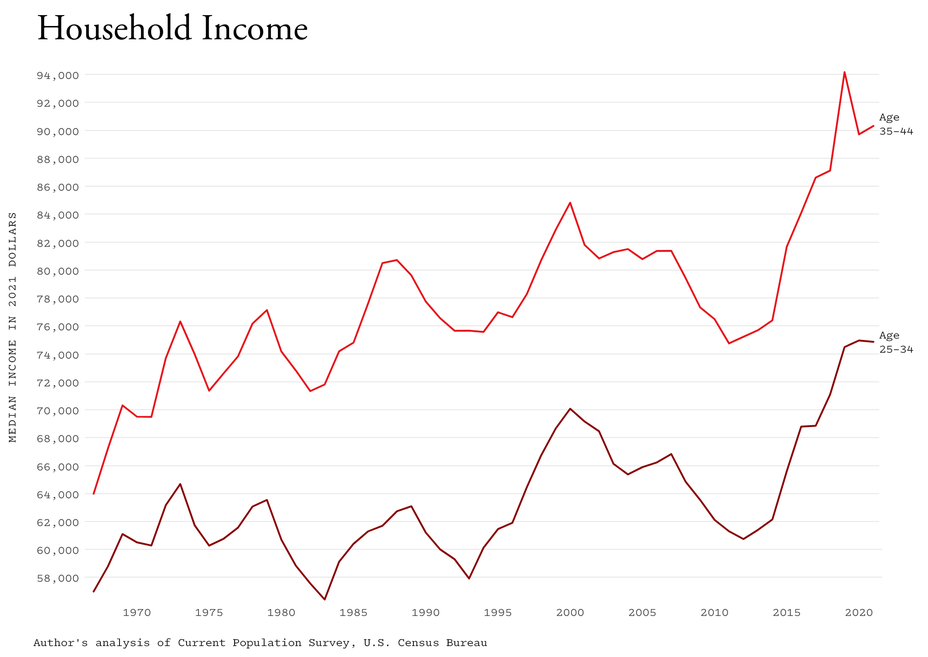

The Great Recession of 2008 was hard on American incomes, especially those of young Millennials (born roughly between 1980 and 1994), who were just entering the job market. By 2012, the median household income of 25-to-34-year-olds had dropped 13 percent from its peak in 2000. But the mid-2010s saw the beginnings of a turnaround that has continued ever since. By 2019, households headed by Millennials were making considerably more money than those headed by the Silent Generation, Baby Boomers, and Generation X at the same age, after adjusting for inflation. That year, according to the Current Population Survey, administered by the U.S. Census Bureau, income for the median Millennial household was about $9,000 higher than that of the median Gen X household at the same age, and about $10,000 more than the median Boomer household, in 2019 dollars. The coronavirus pandemic didn’t meaningfully change this story: Household incomes of 25-to-44-year-olds were at historic highs in 2021, the most recent year for which data are available. Median incomes for these households have generally risen since 1967, albeit with some significant dips and plateaus. And like each generation that came before, Millennials have benefited from that upward trend.

Household income is only one lens, but individual income shows largely the same thing. Booms and recessions push incomes up and down, but although many media stories have tended to associate Millennials almost exclusively with the latter, they’ve now experienced both, and in a big way: Increases in income since 2014 have been steep.

In this, Millennials trace a pattern similar to the Gen Xers before them. Early Gen Xers, too, entered the job market during a recession, and the generation was subject to dire predictions about its economic future (one 1995 book, Welcome to the Jungle, by Geoffrey T. Holtz, described Gen X as the “Impoverished Generation”). But those predictions didn’t hold up after the economy rebounded later in the ’90s. The Great Recession was no doubt a more harrowing experience for young adults than the recession Gen X faced, but the income stagnation that followed it nonetheless lasted only a few years. Over the past half century, the longest period of falling or stagnant wages was from the ’70s to the mid-’90s, when Boomers were young workers. My point is not that Millennials should consider themselves fortunate—I don’t believe that—but rather that economic prospects can change greatly as a generation ages, and especially as it reaches its peak earning years.

The Millennial income rebound has been broad as well as steep. The income of young adults across racial groups has risen since 2014. By my analysis, Black and Latino Americans ages 25 to 44 in 2021 were making more money than Black and Latino Silents, Boomers, and Gen Xers at the same age. The U.S. is not without economic inequities, many of them racial. But Black and Latino Millennials are not falling behind previous generations when it comes to their income. Instead, most are getting ahead.

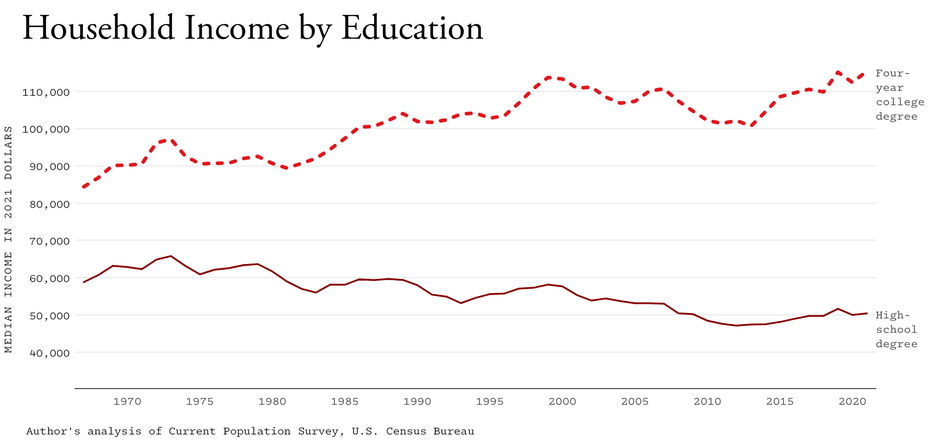

Two groups have not outpaced the generations that came before: men and people with less education. Millennial men, on average, have not seen the income increases that Millennial women have (more on that later)—a divergence at least partly explained by the growing gap in educational attainment between men and women. And overall, the median income of Americans with a four-year college degree has steadily risen while the income of those with only a high-school degree has fallen. This trend is not new, though it is troubling.

Yet there are also far fewer high-school-only graduates among Millennials than among previous generations, and many more with a college degree. Millennials are the first American generation in which more than one out of three had a four-year college degree by their late 20s, up from one out of four when Gen Xers were in that age bracket. And two out of three Millennials have attended college for at least a year.

That has enabled more people to move into higher income brackets, and is one of the main reasons Millennials are doing relatively well financially. But even the story of the generation’s have-nots is complicated, and hardly Dickensian. The least fortunate members of the Millennial generation seem better protected economically than those of prior generations: Fewer Millennials were in poverty in 2019 than were Boomers and Gen Xers at the same age (in 1987 and 2004, years in which the economy was likewise strong). For all the talk of America’s tattered social safety net, that net has in some ways been reinforced since Millennials became adults. The Affordable Care Act extended health-care coverage, and federal-government support during the pandemic actually caused poverty to fall in 2020 and 2021, once you account for that support. Whether because of federal social policy, minimum-wage increases in some states, or other factors, poverty is not any more common among Millennials today than it was among previous generations.

A Generation of Homeowners

A house is perhaps the most tangible embodiment of the American dream. Millennials’ housing woes have featured prominently in media accounts of the generation’s economic (and life) problems. “There should be a Millennial edition of Monopoly where you just walk around the board paying rent, never able to buy anything,” a Twitter comedian who goes by “Mutable Joe” joked in 2016. BuzzFeed ran a story last year on 24 “ways Millennials became homeowners,” filled with decidedly sui generis anecdotes. One described someone who’d been hit by a truck and won a lawsuit, covering their down payment. Short of getting concussed by a semi, the article suggested, Millennials had little chance of becoming homeowners.

But contrary to that narrative, Millennials’ homeownership rates in 2020 were only slightly behind Boomers’ and Gen Xers’ at the same age: 50 percent of Boomers owned their own home as 25-to-39-year-olds, compared with 48 percent of Millennials, hardly a difference deserving of headlines or social-media memes.

Both house prices and mortgage rates are higher now than in 2020. That’s bad news for Millennials who haven’t yet bought a house but want to do so soon. Nonetheless, many older Millennial homeowners got great deals on their most important purchase, having passed into their 30s during the early 2010s, one of the most fortuitous times to buy a house in recent memory. It was Gen Xers, by and large, who were in their prime home-buying years as the great housing bubble of the aughts inflated, and who went underwater when that bubble popped. People who bought a house in 2005, for instance, saw their home’s value plummet 21 percent over six years, on average, and not regain its purchase price until 2014. Older Millennials, in contrast, were buying into a depressed market that subsequently rebounded; houses bought in 2011, for instance, appreciated 40 percent over the next six years. Almost everyone who bought a house in the U.S. before 2019 saw its value shoot up during the pandemic years. And until the past year, just about all Millennial home buyers were able to lock in mortgage interest rates that were at historic lows.

These are national figures, and the picture will vary from place to place. (Housing has not been a bargain in New York City, for instance, where a very large number of Millennial journalists live.) But on the whole, Millennials have not been economically unlucky as to homeownership—if anything, the reverse is true.

Closing the Wealth Gap

Between the toll that the Great Recession took on Millennials’ early careers and the college-loan debt that many of them carry, one might expect this generation to be living more precariously than previous ones, with little financial cushion.

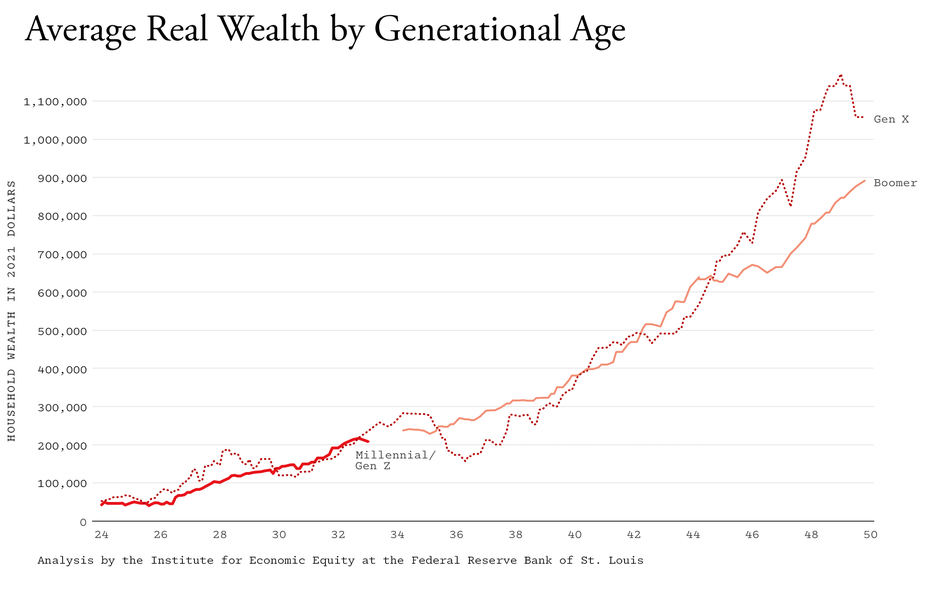

And there’s at least some truth to that. The Federal Reserve Bank of St. Louis made big headlines in 2018 when it announced that among families headed by people born in the 1980s (older Millennials), median wealth was 34 percent lower than what you’d expect based on the wealth of previous generations at the same age. The report, which analyzed data through 2016, theorized that Millennials might be a “lost generation” when it came to wealth.

But when the St. Louis Fed updated its analysis of Millennial wealth a few years later, using 2019 data, it found significant progress. By then, older Millennials lagged only 11 percent behind previous generations at the same age. That progress was uneven: The gap was larger for Millennials without a college degree (19 percent) and even more so for Black Millennials (50 percent). Younger Millennials (born in the ’90s and still in their mid-20s at the time) also faced a bigger gap. Still, since 2019, both housing and the stock market have increased in value, last year’s swoon notwithstanding. Recent analysis by the Fed, including data through the middle of 2022, has shown average Millennial wealth to be neck and neck with the wealth of Gen X at the same age.

Does debt alter this picture? Millennials are without a doubt more heavily burdened by college loans than previous generations. Black Millennials are particularly likely to carry heavy student-loan balances. But again, the Fed’s analysis already takes that into account: Its wealth figures net out college loans and other debts.

Even the wealth gap that exists today may mean less than it first appears to. Because more Millennials went to college and graduate school, they started their careers later, on average, than Boomers and Gen Xers did. On those grounds alone, one would expect a lag in wealth building. But more education typically means higher lifetime earnings—and thus stronger savings potential as the years go by. Many Millennials are just entering their peak earning years and have more earning power than the generations before them.

Meanwhile, the long trend in American life spans has generally been upward. The high-wage manufacturing jobs that Boomers could count on right out of high school also tended to take a toll on the body over time; the shift toward services and office work enables longer career tails. As the saying goes, 60 is the new 50, and this will benefit Millennials in myriad ways.

The New Economics of Family

“I see ‘Millennials Aren’t Having Babies’ is making the rounds again,” tweeted “pokey pup,” a self-identified Millennial, in November 2021. “No one is getting paid enough, there’s not adequate maternity leave, no one can afford hospital bills, most of us can’t afford a house—like what did you think would happen?” The tweet got more than 120,000 likes and more than 25,000 retweets.

Although Millennials’ economic outlook isn’t so dire as many social-media posts would suggest, something is clearly holding Millennials back from having children—and finances are, indirectly, at least a plausible culprit.

As high-school seniors, 95 percent of Millennials said they wanted at least one child. Four out of 10 said they wanted three or more. Those desires have persisted. In the 2018 General Social Survey of adults, Millennials’ average ideal number of children was 2.6. Yet total fertility—the estimated number of children a woman will have in her lifetime based on the year’s births—was just 1.66 in 2021.

Family income itself doesn’t seem to be to blame—after all, Millennials’ incomes are higher than those of previous generations. But the pattern of income—particularly the split between men and women—may play a role.

Millennial women’s incomes are much higher than the incomes of women of previous generations, a result of both higher wages and more hours worked. In 2021, Millennial women ages 35 to 44 made roughly twice as much as Boomer women in 1980, and over 20 percent more than Gen X women in 2005. Women 25 to 34 made similar gains.

Men’s incomes, however, have fallen since 1970 (though not nearly as much as women’s have risen). The statistics aren’t uniform: Men on the higher rungs of the economic ladder have for the most part bucked this trend, and Millennial men’s incomes have rebounded from their Great Recession lows. But that may be cold comfort to men making less than their fathers did, especially those who don’t live (and share expenses) with women—even though men still make more than women on average.

These rapidly changing income dynamics also affect Millennial families. For heterosexual couples, if the woman quits her job when children arrive, the family will lose considerably more income than two-earner families did in past generations. If the man quits, the typical family will lose more than half its income. And if both parents keep their job, the couple must find child care—the price of which has far outpaced inflation as more and more parents have sought it. In most states, child care costs more than a year of college at a state university, and sometimes more than housing.

The balancing act between salaries and child care might be one reason Millennials are having fewer children, and also why some Millennials feel they are not doing as well as their parents. In a 2018 poll by The New York Times, 64 percent of young adults who said they expected to have fewer children than their ideal named “child care is too expensive” as the reason.

Still, this argument shouldn’t be taken too far. If Millennials need to spend more income on child care than previous generations did, they also need to spend less on many other things. After accounting for inflation, the prices of cars, clothing, furniture, toys, and electronics have all fallen in recent decades. These are not, for the most part, minor line items in a family budget—or at least they weren’t in, say, the 1980s.

The link between family finances and having kids is also weaker than you might think. On average, families with more income actually have fewer kids; those with less income have more kids. A recent paper by the economists Melissa S. Kearney, Phillip B. Levine, and Luke Pardue showed that states with bigger increases in child-care costs have not seen steeper declines in birth rates—and found, more broadly, that economic factors were not the major driver of falling birth rates. Instead, they concluded, albeit speculatively, that “shifting priorities across cohorts of young adults”—that is, generational differences in attitudes—are the primary explanation. Hypothetically, the logic goes, Millennials might want more children, but when they trade off kids versus income, professional success, and other goals, kids get slotted lower than in previous generations.

Why Millennials Still Feel Poor

Every generation faces financial challenges, including some that its parents’ generation did not. Within every generation, there is hardship, and Millennials are no different. But all in all, this is a generation on the cusp of middle age that looks successful, not lost. So why does the idea persist that Millennials have gotten screwed economically? Why is the narrative around Millennials still so negative and sometimes angry?

Incomes and wealth are not just objective numbers—there is a large element of perception involved in whether someone thinks they are doing well.

Human beings are hardwired to care deeply about status, and we assess it in two different ways. At any given moment, we look around to see how we’re doing compared with our peers. And we reflect on our own past and future status as well: Are our lives getting better? Are we better off than our parents, and will our children be better off still? Both of these forms of status affect our well-being. A number of factors inherent in modern society may have pushed many Millennials toward a distorted view of each.

Before social media, and before the proliferation of lifestyle and reality TV, the only rich individuals most people encountered were from the particularly well-off families in their town. Now the rich (or at least those who appear to be rich) fill our feeds and our screens, providing a skewed view of how other Americans live. The Kardashians cannot, in fact, be kept up with. Online, everyone else’s life looks more glamorous than our own. The resulting sense of “relative deprivation,” as it’s known among psychologists, no doubt afflicts Americans of all ages—but Millennials have spent their entire adulthood in this milieu, and remain more online than older generations.

Meanwhile, negativity in the news—which, studies show, has become much more pronounced in recent years—has colored perceptions of generational progress. A seemingly endless array of articles and news segments have repeated the idea that Millennials have gotten the shaft economically, an idea that social media amplifies further. (When government economists worry that Millennials might be a “lost generation” as to wealth, it generates news; when they later say that Millennials have greatly narrowed the wealth gap, the coverage is quieter.)

This constant drizzle of grievance and disappointment falls daily on a generation that carried extraordinarily high expectations into adulthood—more than half of Millennials, for example, expected to earn a graduate degree. In a 2011 survey, Millennial teens believed they would make, on average, $150,000 once they settled into their career—more than four times as much as the median income that year. “There is a profound gap between the expectations we were raised to hold and the reality we now experience,” Filipovic writes in OK Boomer. Given those expectations, some Millennials’ disappointment with their status and material success might be baked into the cake.

But expectations do change over time, and perceptions adjust. The Fed’s 2021 Survey of Household Economics and Decisionmaking showed that a small majority of Millennials, 53 percent, believed they were doing better than their parents at the same age. That hasn’t seemed to translate into a more buoyant public discourse, nor to positive views of American capitalism among young adults—in 2021, a Gallup poll showed that nearly half of all 18-to-34-year-olds had a positive view of socialism, compared with only about a third of those older than 55. But it’s encouraging nonetheless.

Whatever one’s views of socialism, it matters whether Millennials are doing better or worse than the generations before them—and, more important, whether they believe they are. The erosion of faith in material progress has already reshaped political values and changed the tenor of American culture, and the longer it persists, the more it will continue to do so. Rising prosperity and the optimism that follows carry benefits that extend well beyond material comfort. They make social comparisons less obsessive and, as the economic historian Benjamin M. Friedman observed in his 2006 book, The Moral Consequences of Economic Growth, create an environment in which hatreds cool, cooperation becomes easier, and human rights advance more readily.

If Millennials keep doing well economically, the optimism that characterized their childhood and adolescence may eventually return. The scars of a searing start can take time to fade, but they eventually might. And if Millennials’ expectations are now lower, they may be pleasantly surprised by their financial success, leading to more contentment in middle age.

Perhaps not long from now, financial pessimism will be talked about as the latest item on the list of things Millennials have killed. That particular murder might be welcome.

This article is adapted from Jean M. Twenge’s book Generations: The Real Differences Between Gen Z, Millennials, Gen X, Boomers, and Silents—And What They Mean for America’s Future. It appears in the May 2023 print edition with the headline “The Myth of the Broke Millennial.”

When you buy a book using a link on this page, we receive a commission. Thank you for supporting The Atlantic.

[ad_2]

Source link